Using Annuities to Provide Stable Retirement Income

Using Annuities for Retirement Income, Long Term Care (LTC) Funding, Gen-Xers, and even Millennials.

Annuities are an investment class that can provide stable monthly income for Long Term Care (LTC), and provide a smart financial foundation for Millennials. In modern day employment contracts, the chances of being able to sign-up for pensions as part of your benefits package is as likely as seeing your favorite Dinosaur in New York city…..not going to happen.

Annuities were created to provide lifelong income and provide a peace of mind that the annuitant will never outlive their income. Annuities have evolved from these basic beginnings to provide a funding for a variety of other needs such as funding Long Term Care expenses or producing partial stock market gains when the market goes up with no downside risk if the market goes down (this is a feature of Fixed Indexed Annuities, not Variable Annuities).

Some annuities also pay an additional death benefit over and above the cash value of the account upon the annuitant passing.Before we look at how annuities can support many lifestyle needs. Let’s go through a quick guide as to what annuities are and the different types that exist.

What are Annuities?

Annuities typically can fall into two different categories, deferred and income – both of which can potentially be relied upon as a stable asset protection plan for your savings, drive increased growth to your savings, or generate a consistent stream of income.

You can fund an annuity prior to, at, or during retirement. The life on an annuity goes through two phases. There is the accumulation phase, where you fund the annuity as you would with other financial products. Then, there is the income, or annuitization phase. It’s during income, or annuitization phase that the insurance company begins making steady payments to you. To find the best annuities for retirement, it's advisable that you speak with a qualified Financial Advisor or Wealth Manager.

Types of Annuities

- Variable Annuities: The cash value of this type of annuity can go down if the investments in the account lose value. However, the amount of lifetime income the annuity is contractually obligated to pay the Annuitant, increases, at least yearly, no matter what the market is doing. A variable annuity can be turned into a lifetime income stream during the life of the contract.

- Fixed Annuities: The basic version of this type of annuity pays a fixed amount of interest on the invested balance. The annuity company is contractually obligated to provide you with your original investment plus the stated interest at the end of the contract. A fixed annuity can be turned into a lifetime income stream during the life of the contract.

What are Investment-Only Variable Annuities?

Investment-only variable annuities (IOVAs) carry low monthly fees and more importantly, allow investors to defer taxes on income generated by the annuity until the money is taken out for spending which can potentially mean savings of thousands of dollars over time depending on the size of the contract.

An investor in this type of annuity can take as much market risk as they desire, putting all the funds into the stock market if they so choose. The annuity company allows for this feature because they do not have to guarantee a certain amount of lifetime income to the investor.

The annuity will be worth whatever the investments in the annuity are valued at.Annuities have grown in popularity recently in large part due to investment only variable annuities. The tax deferral feature of the investment only variable annuities has also made them popular amongst investors.

1 Source: May 2017 Gallup Poll

2 Source: Employment Benefits Research Institute, March 2017

3 Source: Social Security Administration

Who Could Benefit from Investment-Only Variable Annuities?

- Wealthy Investors in the higher tax brackets with a large portion of investable assets in taxable accounts.

- Investors that are at least 10 years away from retirement looking for investments with benefits of tax deferral.

- Investors that have maxed out their 401K and/or IRA contributions.

- Any investor with tax-inefficient investments.

Fixed Income Annuities

Some conservative investors would like to have partial exposure to the upside of the stock market, but cannot bare the feeling of losses associated with the stock market. For these investors Fixed Indexed Annuities are often appropriate as part of their investment strategy. They offer complete protection form downside (e.g. bear market) risk while delivering the investor returns linked to a market index.

Fixed Income Annuity Example

Investment Periods | Market Performance | DOW Performance | Annuity Performance |

|---|---|---|---|

Year 1 | Dow is Up | 14 % | Generated 8% Return |

Year 2 | Dow is Down | -12 % | Generated 0% Return |

Year 3 | Dow is Up | 7 % | Generated 3.5% Return |

~Hypothetical example for illustrative purposes only.

As you can see the return scheduled vs the market is quite attractive considering the absence of down years.

Why is the Tax Deferral Feature of Annuities so Valuable?

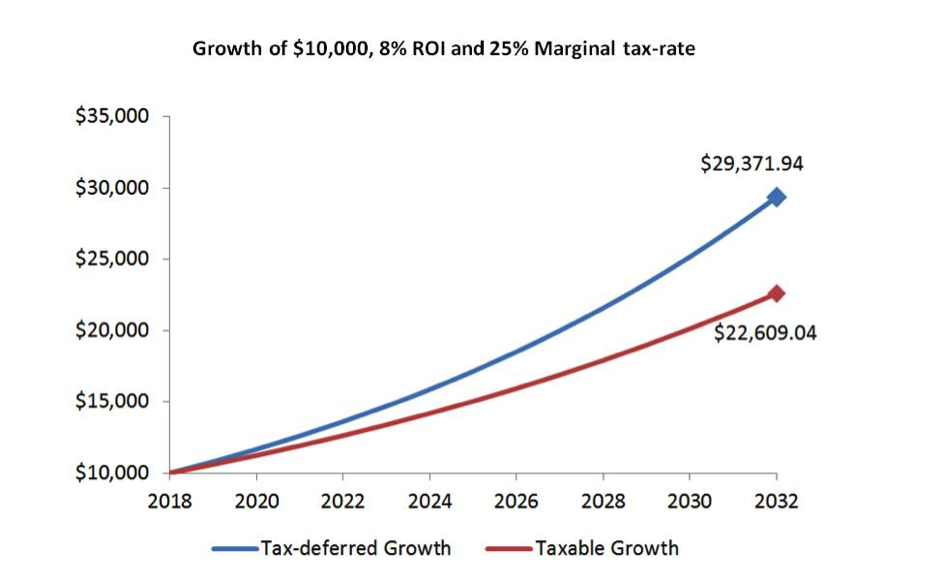

Below is an examples char that will help visualize benefits of tax deferral.

~Source: Dividendgeek.blogspot.com |~Hypothetical example for illustrative purposes only.

As shown in the graph, because you are not paying taxes yearly you will be able to accumulate more, and when it’s time to annuitize, you would receive a higher amount of stable income on which you will pay taxes, (just on the gains), and likely at a lower tax bracket then when you were still fully employed.

Using an annuity as a tax-efficient strategy does however, have some cons. If you happen to withdraw the funds before attaining the age of 59 ½, the IRS can assess a 10% penalty.

Is An Investment Only Variable (IOVA) Annuity Right For You? How Can You Get Some Independent Advice?

Before opting for the IOVA, you need to be sure it is necessary to achieve your Financial Goals.

Gary Korolev, CFA the Principal Wealth Manager at Sovereign Wealth Management, can help you crystalize your plan and figure out whether an IOVA is appropriate for your portfolio.

The Financial Advisors and Wealth Managers at Sovereign Wealth Management (Vienna, VA) can help you develop a Long Term Care investment plan with a balance of annuity strategies that address your need for capital preservation, portfolio growth, income, and risk management.

Annuities Can Also Be Used To Pay for Long Term Care Needs

The older you get, and the more people you see go broke from paying for Long Term Care Term Care, the more you realize the benefits of Long Term Care planning. The future is unpredictable. That’s why it critical to start planning for how you are going to fund your future care needs.

Most investors are familiar with traditional Long Term Care insurance programs where you pay ongoing premiums in exchange for Long Term Care coverage if the need arises. If you pass away without using the coverage the policy just disappears with no rebate of any kind.

A Long Term Care (LTC) annuity, is that provides LTC Coverage, but what if you pass away without needing LTC Coverage? Unlike traditional LTC Insurance, an LTC Annuity will rebate most, all, or more than your original premium invested in the LTC Annuity, to your heirs.

In addition, LTC annuities usually have less stringent health underwriting procedures than traditional LTC insurance. LTC annuity distributions are tax-free when the funds are used to cover LTC expenses.

How Long Term Care Annuities Work

Long Term Care annuities enable you to maximize your LTC coverage by providing a coverage amount as much as 5 times your original investment.

Long Term Care annuity care policies are divided into two phases. The first phase involves a payout of a cash value to you on a monthly basis over 2 or more years (typically). The second phase entails the extension of Long Term Care benefits. That is, the annuity company continues paying you even after your cash has been exhausted. This goes on for the stated term of the policy. It could even last your entire lifetime depending on the policy terms.

If you find that LTC coverage is not needed anymore, you can cancel the policy and get your money back (there may be surrender charges in the first few years of the policy’s existence.)

What are the Benefits to Long Term Care Annuities?

- Annuities qualifying for Long Term Care coverage are considered as tax-free per the Pension Protection Act of 2006. The tax-free withdrawals ensure maximum coverage of your Long Term Care needs.

- You can be assured of zero penalties when it comes to exchanging an existing life insurance or annuity contract into a Long Term Care annuity policy. This is stated under section 1035 of the Internal Revenue Code.

- Long Term Care hybrid annuities have less strict health underwriting requirements and/or guidelines, which could help your application get app. Unlike traditional Long Term Care policies, annuities don’t have strict health guidelines.

Enter your text here...

The amount of coverage that can be purchased in an LTC annuity is reduced the older you are.

For Example:

- Betty is 60, she invests $100,000 in an LTC annuity. The resulting LTC coverage is $400,000.

- Mary is 70, she invests $100,000 in an LTC annuity. The resulting LTC coverage is $200,000.

- Depending on your financial situation and preferences, LTC annuities could be a better option for your Long Term Care health care needs. The last thing you want in retirement is to bankrupt your estate due to uncovered Long Term Care expenses.

Why Should Gen-Xers or Millennials Consider Annuities as an Investment Strategy?

If you take a look at most annuity adverts, you will notice they mainly target seniors. Retirees are usually considered as the ideal candidates for annuity strategies, however, does that mean that annuities are inappropriate for all Millennials? Definitely not!

Many investors in their 30s, 40s and 50s are in a higher tax bracket, and if they have already maxed out their retirement account, investing in an annuity is an ideal way of deferring taxes until retirement when their income and therefore tax bracket, is likely to be lower.

All of us are bound to retire at one point or another. If you work in the private sector, like most people, you’re not likely to be receiving a pension. For those who do work for the government and can expect to receive a pension, the monthly income won’t be as generous as that of pensions in the past.

So how can you create your own custom pension? For example, say you purchase a fixed deferred annuity with an income rider that grows at 7%. If you put in $300,000 for the duration of 20 years without making any withdrawals, the amount of guaranteed income increases four fold and the annuity company will guarantee between 5% to 7% income for life on $1.2 million no matter what the cash value of the annuity is at this or any time in the future. 5% of $1.2 million is $60,000 per year.

This is a significant amount of money that would meet most retirement expense needs for many retirees. This way the rest of the funds which are invested in the market and have a risk of loss can continue to grow unencumbered by withdrawals during downturns.

There are downsides to annuities. Most have surrender charges for the first 3 to 10 years if the owner withdraws more than 10% of the principal per year, so an investor should only put that money into annuities which is meant to stay invested long term. Some annuities can also have complex riders and high fees, so talking to a Wealth Manager knowledgeable in this matter is important to help figure out the best option for your particular situation.

Take the bold step today and speak with a Wealth Manager at Sovereign Wealth Management to construct the optimum strategy that best meets your lifestyle and Long Term Care retirement needs.

As with all investments, it’s strongly advised to speak with a competent and knowledgeable Financial Advisor before implementing the strategies discussed above. Diversification neither assures a profit nor eliminates the risk of loss. This article is being provided for educational purposes only and should not be considered a recommendation of any particular strategy or investment product or investing advice of any kind. Information contained herein has been obtained from sources deemed reliable but Spire Wealth Management, LLC and its affiliates do not guarantee its accuracy. The views and opinions expressed in this article are those of the author and do not necessarily reflect the opinions of Spire Wealth Management, LLC, Spire Securities, LLC or its affiliates. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.Spire Wealth Management, LLC is a Federal Registered Investment Advisory Firm. Securities offered through an affiliate, Spire Securities, LLC. Member FINRA/SPIC.