Retirement Strategies to Survive Bear Markets

Bear Market Retirement Strategies

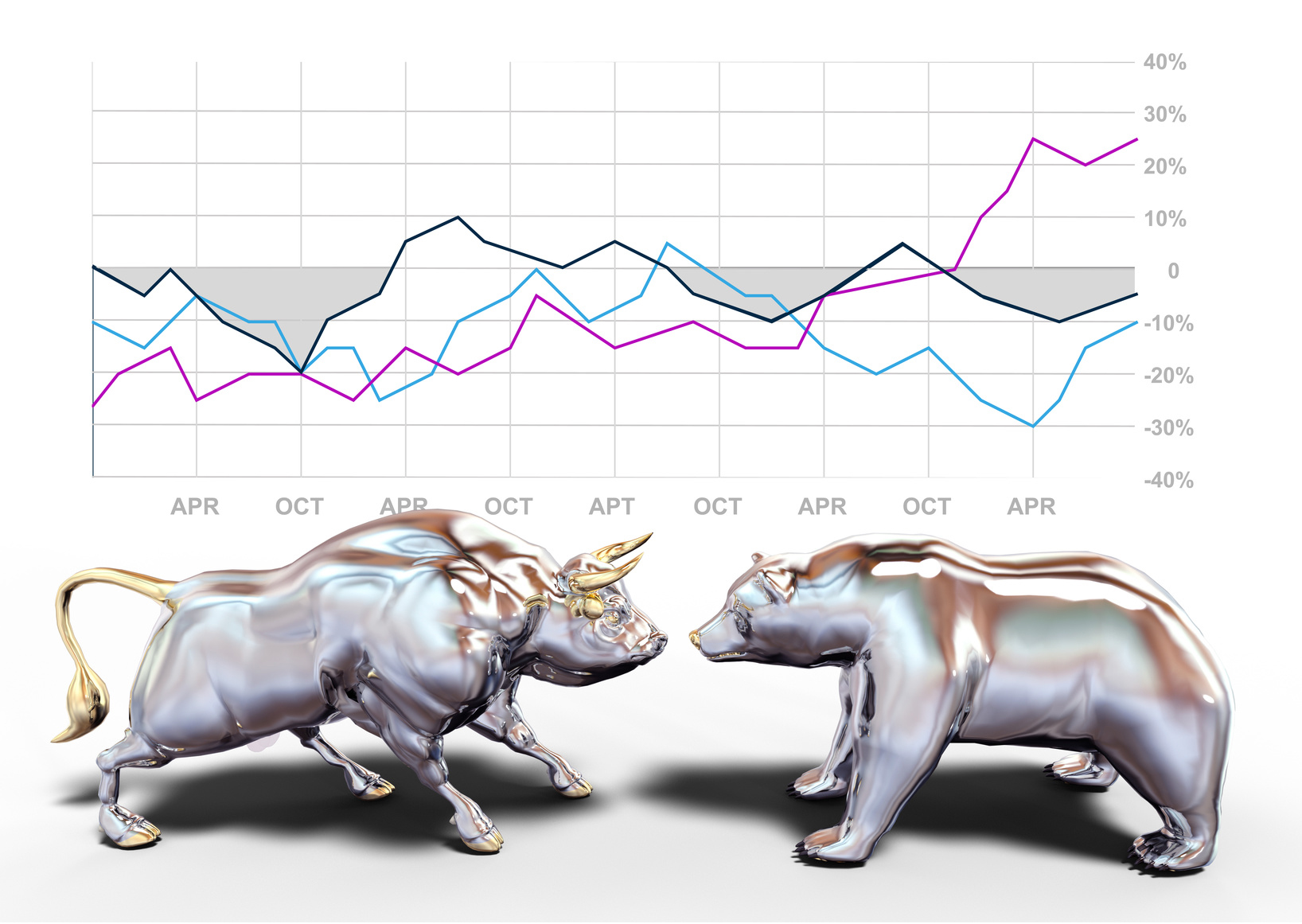

Individual investors approaching or already in retirement may be wondering how to survive the various challenges associated with the US bear market conditions. A bear market refers to the state in which the prices of securities fall 20% from recent highs, where market conditions remain characterized by widespread pessimism as well as negative investor sentiment.

In the midst of volatile or bearish markets, investors should transition their energy from worrying about asset devaluation to making portfolio shifts that mitigate losses and execute investment strategies that actually generate positive returns or cash flows. There are various retirement strategies that, with the help of a qualified retirement financial advisor, help protect your assets from large losses in a bear market. As a retiree or investor looking to secure the income that supports your lifestyle, one may want to consider implementing a tactical investment strategy capable of potentially shielding assets from market volatility.

Planning & Executing a Retirement Investment Strategy

The process of implementing relevant or appropriate strategies begins with identifying, understanding, and acknowledging causes of a bear market. The determinants of bear markets cut across various macro-economic conditions that often result in a sluggish economy. For example, low employment, reduced business productivity and profits, low disposable income, and market volatility as some initial indicators.

From a technical perspective, a market with the majority of traded stocks on a downward trend is for that reason named a bear-market. A more “technical” definition would be a drop of 20% or more in the Dow Jones Industrial Average or S&P 500 throughout two (2) or more months. Below are strategies that could help weather volatile bear market conditions.

Interventions by the government can also play a role in triggering bear markets. For instance, significant changes (increases) made to lending rates could lead to bear market conditions.

Retiring and change-oriented investors must remain focused on different indicators, including high market valuations, geopolitical events, low earnings growth, as well as rising interest rates. Below are investment options worth discussing with a qualified financial advisor.

Indexed Annuities

Given the need for many retirees to have income generating assets during volatile stock market conditions, fixed indexed annuities allow investors to potentially generate higher yields linked to the performance of the stock market, while at the same time, offering downside protection from losses in principal.

Here is an example of how a fixed indexed annuity could work: Let’s say the contract stipulate that the annuity provides a return of 50% of the SP500 on a yearly basis:Investment Periods | Market Performance | S&P 500 Performance | Annuity Performance |

|---|---|---|---|

Year 1 | S&P 500 is Up | 12 % | Annuity generates a return of 6 % |

Year 2 | S&P 500 is Down | -10 % | Annuity generates a return of 0 % |

Year 3 | S&P 500 is Up | 8 % | Annuity generates a return of 4 % |

Despite their huge potential in enhancing the survivability of investor portfolios during bear markets, critics argue that fixed indexed annuities remain characterized by limits on returns. On the contrary, recent and previous studies have so far established that investors, who invest in fixed indexed annuities, are comfortable with giving up some upside to hedge downside risk. According to the Wheaton Financial Institution Center:

Indexed Annuity returns have been competitive with alternative portfolios of stocks and bonds and have limited downside risk associated with declining markets. And they also have achieved respectable returns in more robust equity markets.

Partial Investment in Cash

Apart from fixed indexed annuities, another reasonable strategy involves selling overvalued securities in your portfolio. Although this requires comprehensive analysis, its key benefit is having the cash to buy higher yielding, lower risk investment or value equities as they become cheaper, while at the same time, potentially protecting the investor’s portfolio when faced with the declining market conditions.

However, the main danger associated with going partially into cash is that a bear market may last many months (or in some parts of the world for years). This creates uncertainty for investors with cash in terms of when to get back into the market. If not done at the right time (too soon), this could expose the investor to the forthcoming bear market pressures.

Investing Using Stop Loss Orders

Stop loss orders can play a pivotal role in protecting portfolios in markets with increased downside risk. A stop loss order is often placed just below the prevailing or current price. If the stock falls to the stated or established price, the sale of the investment is done automatically. In this way, as a retiree or investor, you enjoy the freedom of keeping your portfolio until the stop loss is triggered. If the market picks up without hitting the stop, your portfolio manager, at your behest, can raise the stops so that additional profits are captured.

While they can be protection strategies, stop loss orders are not 100% guaranteed that your stock will be sold at your stop price. That is because the stop loss is a market order and will be executed at the first available bid in the market. If the stock drops below the stop price, your order may be executed at a lower price depending on market conditions and liquidity in the stock or Exchange Traded Fund (ETF) position at the time.

Fixed Income Portfolio

Retirees and investors should look into conservative investment strategies, given increased volatility and risks in the equity market. They should consider tactical fixed-income strategies that support a broader overall strategy. The reason for investing in fixed-income investments would be to support withdrawal distribution income and achieving tactical portfolio diversification.

Tactical Asset Allocation

Tactical asset allocation (TAA) serves as one of the best possible investment tools to navigate the complicated and multifaceted full market cycles. Sovereign Wealth Management’s, Gary Korolev, CFA, concurs that TAA offers a broad range of opportunities, including potentially lower Maximum Drawdowns, as well as higher likelihood of increased Compound yearly growth rates across a bull-bear market cycle.

Additionally, another advantage associated with TAA involves its rule-based, change-driven, and mechanical approach, which allows investors to maintain market-oriented portfolios. TAA cuts risks as opposed to spreading them across asset classes, which, in turn, minimizes the anxiety involved in the whole process of portfolio management.

Tactical Asset Allocation combines an active management strategy with the use of low-cost passive funds to potentially improve retiree and investor income while reducing risk of large losses. There is significant amount of compelling academic research supporting the use of TAA to manage part or all of an investment portfolio. This approach can also blend a diversified bond portfolio with a tactical stock ETF strategy to provide a combination of steady income and stock market exposure with potential for reduce downside risk.

Active Trading Strategy

Active trading is another strategic method that could allow your retirement and investment portfolio to survive a bear market. According to Gary Korolev, CFA, Principal Wealth Manager at Sovereign Wealth Management, “the investment approach is not for every investor since there is a higher risk of losing capital. What’s being recommended here is certainly not day trading.” Rather, Active Trading refers to:

Watching a particular security and trading it from point A to point B and not caring if it goes further up. Most importantly, a trader has to be willing to take losses if it doesn't work out right.

The benefits to this approach are higher rates of return on your portfolio but that would have to be weighed against the risk of losing your capital quite easily.

Trades can become long-term holds if they decline and you do not have the discipline to take the loss. Also, investors can get greedy and start to get in over their heads by trading too much too often. That is when problems can happen and losses pile up quickly.

Quote Source: John Riley - Cornerstone Investment Services

Conclusion

Volatile and/or Bear markets require retiree investors to develop and implement the right strategies to prevent asset loss or devaluation. Of the solution-oriented frameworks identified and briefly discussed in this article, it is apparent that using TAA and fixed-income portfolio offers the most sustainable solution to retirees during a bear market. The two strategies place great emphasis on diversification, income growth and asset protection.

As with all investments, it’s strongly advised to speak with a competent and knowledgeable Financial Advisor before implementing the strategies discussed above. Diversification neither assures a profit nor eliminates the risk of loss.This article is being provided for educational purposes only and should not be considered a recommendation of any particular strategy or investment product or investing advice of any kind. Information contained herein has been obtained from sources deemed reliable but Spire Wealth Management, LLC and its affiliates do not guarantee its accuracy. The views and opinions expressed in this article are those of the author and do not necessarily reflect the opinions of Spire Wealth Management, LLC, Spire Securities, LLC or its affiliates. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.Spire Wealth Management, LLC is a Federal Registered Investment Advisory Firm. Securities offered through an affiliate, Spire Securities, LLC. Member FINRA/SPIC.