Retirement Income Strategies in a Rising Interest Rate Environment

Retirement Income Strategies in a Rising Rate Environment

Given the current regulatory and economic climate, it is clear that we are headed for a period where interest rates will be consistently rising, most likely at a gradual pace. It’s also clear through review of the Consumer Price Index (CPI) that the cost of living across many consumer and commercial goods and services are seeing an increase in price because of inflationary pressures.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available.

Source - US Bureau of Labor Statistics

As interest rates continue to rise, investors find themselves not only with stocks becoming more volatile but also with bonds which are starting to lose value like they have not done for several decades.

So what is an investor looking for a sound, stable source of retirement income, to do?

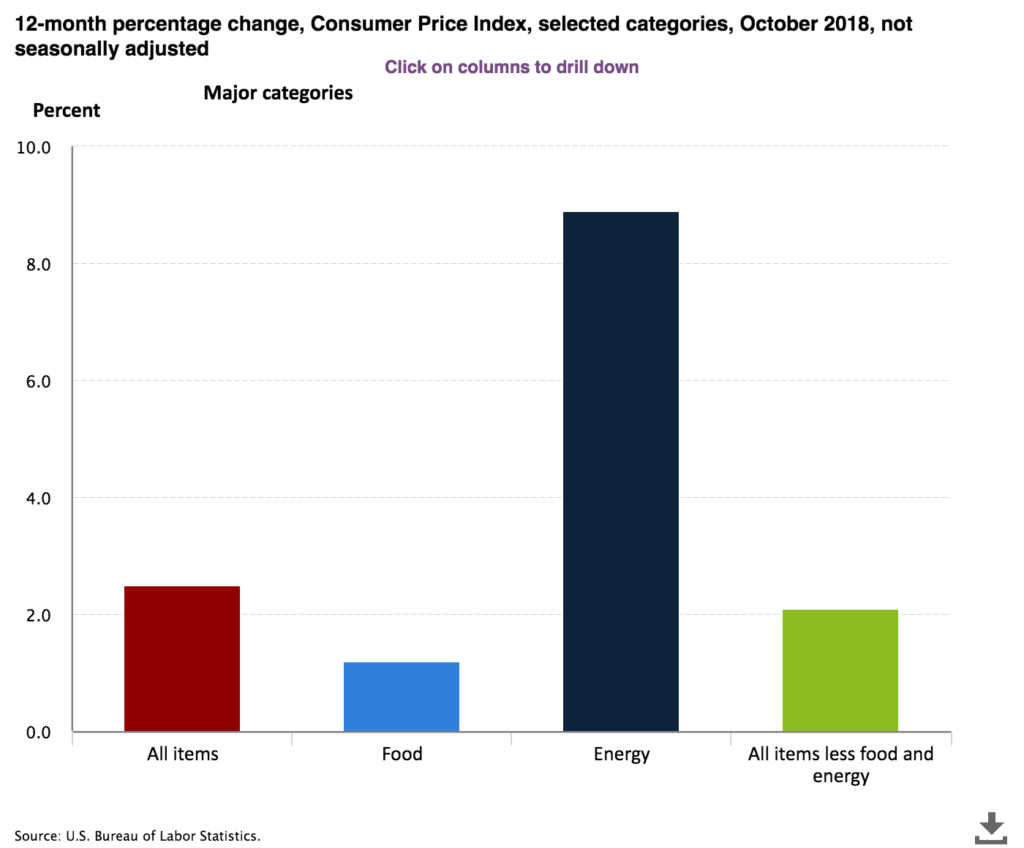

Below we will describe some of the options we use in combination to produce a sound retirement income strategy. But first, for perspective, a bit of economics.As you can see from United States Department of Labor graph below, the CPI numbers over the past few quarters are up. This is a likely result of the many years of low interest rates we experienced as part of the Federal Reserve’s monetary policies. Inflation has been slowly rising and has impacted prices across energy, food and many other sectors - an it appears to be in an upward trend..

12 Month Percentage Change in CPI | Food, Energy & Everything Else

Source - US Bureau of Labor Statistics

For many retirees, the impact of inflation and rising rates are certainly felt when you spend nest-egg resources for buying groceries, filling up your tank with gas, and planning your vacations.

With the Federal Reserve continuing to tighten monetary policy and the US Administration pursuing aggressive trade policies, retirement income planning is necessary to extend your existing asset base throughout your retirement. The objective would be to define a strategic approach to Retirement Income so that you can not only insulate yourself, but even profit from a rising interest rate environment.

What Causes Interest Rates to Move Up?

We’ll cover a bit of economics before we get to retirement investment strategies. You might be asking, “what causes rates to go higher?" According to macroeconomic principals, there is an inverse relationship between inflation and interest rates. A simplified example of the relationship between interest rates, inflation and savings is:

The interest rate acts as a price for holding or loaning money. Banks pay an interest rate on savings in order to attract depositors. Banks also receive an interest rate for money that is loaned from their deposits. When interest rates are low, individuals and businesses tend to demand more loans. Each bank loan increases the money supply in a fractional reserve banking system. According to the quantity theory of money, a growing money supply increases inflation. Thus, a low interest rate tends to result in more inflation. High interest rates tend to lower inflation.

Source - Investopedia

Short Answer – The rise in inflation has trigger the Fed to start increasing interest rates. This will continue over the next few foreseeable quarters and will have a strong impact on your portfolio.

As interest rates rise, Central Banks start raising interest rates to get inflation under control. Higher interest rates mean higher cost of capital for businesses and consumers which reduces the velocity, or movement of money throughout the economy, thereby reducing inflation.

Whether you're now starting to invest for your retirement, already have a retirement plan in place but looking for better asset appreciation / returns, or if you're in or near retirement age and want to ensue you've have enough income to carry you through, employing a mix of the below investment options could be beneficial to your overall portfolio.

13 Investment Strategies in a Rising Interest Rate Economy

Bond Liquidation & Raising Capital (Cash)

The longer term the bond, the more it goes down in value as rate rise, this feature of bonds is called Interest Rate Sensitivity.

To take advantage of rising rates, the simplest thing would be to review your bond portfolio where yields are low, and duration is high, liquidate these bonds and keep the proceeds in a higher interest bearing money-market / cash account, which could see better returns as interest rates rise.

This would be considered a defensive retirement / investment strategy but one that could yield better returns than a low interest, long term bond in a rising rate environment.

Short Term Bond Play

Another strategy would be to invest in short-term bonds since they are likely to pay a higher rate of interest than money market accounts. One thing to keep in mind would be that there is risk of a decline in the value of a short-term bonds, whereas in a money market account your investment will not decrease as interest rates fluctuate - your compounded rate of return would only fluctuate with no loss in your capital.

Floating Rate Bonds

These bonds adjust the rate of interest they pay as interest rates rise. Due to this feature, the interest rate sensitivity, or the risk of floating rate bonds losing value as rates rise, is much lower. There are a number of different types of bonds, from government bonds to lower rated corporates.

Bond Ladders

Bond ladders provide investors with the ability to select from different types of bonds. Some popular bonds include treasury bonds, municipal bonds, and even CDs. These bonds should have different maturity dates that can be spread across several years. When the bond matures a person can put the money into a new bond with higher yields and have a later maturity date.

No market timing is needed. An investor will then be able to enjoy the income when the bonds mature after they retire. A sizable investment is going to be needed. It is recommended to start these investments early so the money will have years to grow.

Municipal "Kicker" Type Bonds

These bonds are also known as kicker bonds. They will allow the investors to increase the yield on the bond without having to worry about credit quality. These bonds have a higher interest return percentage that other type of bonds.

Because kicker bonds have higher-than-current-market coupons – 5 percent versus 2.50 percent, for example – they usually offer stronger yields and higher cash flow than typical bonds, with one important difference. A kicker bond can be redeemed or “called” by the issuer well ahead of its maturity date, which means an investor would have to invest the funds elsewhere if the bond is called. But if it’s not called early, the investor’s yield rises or “kicks up” as the effective maturity of the issue extends. It’s important for investors to understand the built-in uncertainty of the potential call, says Mark, but also to recognize that the risk is offset by a higher yield.

Source – RBC Wealth Management: Six fixed income strategies for a changing interest rate environment

This retirement income strategy would be best for the investor that is willing to take on a little more risk or potential volatility given the “callable” nature of the bond. Our Financial Planners at Sovereign will be able to advise you on the best approach to incorporate these higher return asset categories into your retirement portfolio.

Interest Rate ETFs & Hedge Funds

These investments involve holding treasury, investment grade corporate, and high yield corporate investments that provides investors a more attractive dividend yield. In order for this strategy to work best, the hedge fund or ETS would sell short treasury bond and/or treasury note futures in order to offset the risk of potentially lower bond prices to offset any risk.

The objective with these investments would be obtain higher yields while reducing risk if there is an increase in the interest rates. Long-term research is still being conducted so it is important to watch the rate. Investors like these bonds because they can have a higher rate of return than other investments and they can take measures to reduce the risk of losing their investment.

Some of the Pros and Cons for interest rate hedge fund and ETFs are as follows:

Pros: Can allow an investor to continue to earn higher yields while potentially offsetting some or all risk associated with higher interest rates.

Cons: Limited track record, so hard to gauge effectiveness of hedging feature. Also, many interest rate hedged funds are not heavily traded.

Pros & Cons as Noted by Schwab: 6 Strategies for Dealing with Rising Interest Rates

Although interest rate hedge funds and ETF can offer attractive returns to investors, it is strongly recommended that you do some research and speak with a qualified and experienced Financial Planner or Wealth Manager as this strategy is relatively new.

Real Estate Retirement Income Investment Strategies

With the interest rates on the increase, many retirees are encouraged to invest in real estate. There are two types of real estate investments to consider and implement. Retirees and younger investors can choose to between Public or Private real estate vehicles to determine which, in not both, strategies would work best.

Public Real Estate Investments

This investment strategy allows a person to invest in real estate investment trusts also known as REITs. When interest rates rise, there is typically a higher cost of serving the debt, which in turn decreases dividend payout and investment returns. If invested properly the impact of the rising rates can be small. As an example, if the duration of a lease on that multi-family property is short, then the investor could have time needed to pivot / adjust or reallocate capital. One thing to keep in mind with REITs in a rising interest rate environment is that the population of renters in the market is likely to increase since getting approved for a mortgage will be more difficult and buying a home would technically be more expensive. This higher renter base will have a positive impact on investors looking to (multifamily) REITs .

Private Real Estate Investments

Private real estate investment will likely have a higher return on investment (often 6% to 12% per year) than public real estate when we're in a rising interest rate environment. This investment strategy includes Mortgage Investment Corporations (MICs), Private Equity Real Estate Funds, and Limited Partnerships.

A major advantage of these funds is that the price does not fluctuate daily, like it does for publicly trades securities, allowing the investor to concentrate on the fundamentals of the investment instead of being distracted by day to day market movements. This advantage is balanced by the illiquidity of these investments, or the relatively difficulty of selling them, which involves paperwork and redeeming the shares directly with the fund.

Most Private Placements have a lockup period where the investor cannot get out of the investment for several years. Most Private Placements are available only to High Net Worth Investors (Accredited Investors, Qualified Investors, or Qualified Purchasers as defined by the SEC.)

Rate increases should be accompanied by a strong economy, translating to Net Operating Income (NOI) growth and thus better property prices. MICs see increased demand as more people turn to private mortgages in light of tougher mortgage regulations and higher interest rates that prevent them from qualifying at a regular bank. Unless these assets are severely leveraged, the long-term private real estate investor should not be utterly concerned with their position, especially if cash flow is strong.

Quote Source - Hawkeye Wealth: Real Estate in a Rising Interest Rate Environment.

Private Placement Credit Funds

These funds, which are also often restricted to Accredited Investors, Qualified Investors, or Qualified Purchasers as defined by the SEC, offer yields often ranging from 6% to 14% per year with little or no fluctuation due to interest rate risk due to the way they are valued, which is based on independent audits looking at the fundamentals of the investments and not the daily whims of the market.

These investments have higher minimums ($50,000 to $500,000 or more) and lockups of several years, where interest is paid but the principal cannot be accessed until the lockup is complete.

Hedge Funds

Also a type of Private Placement restricted to Accredited Investors, Qualified Investors, or Qualified Purchasers as defined by the SEC, offer a variety of strategies to produce income with relative stability. These investments have higher minimums ($50,000 to $500,000 or more) and lockups of several years, where interest is paid but the principal cannot be accessed until the lockup is complete.

Investing in Annuities

Annuities were originally used only as vehicles for guaranteed income for a specific period of years, or for the entirety of a person’s or couple’s life. Annuity offerings have increased in number and type so much that investors now use some types of annuities purely as investment vehicles with no downside risk, while other types of annuities are still used to provide guaranteed income.

Annuities can serve as an excellent low risk income strategy in a rising interest rate environment, since certain types of annuities allow the investor to receive a fixed rate of interest, or part of the upside of the stock market, while protective the investor from all of the downside of the stock or bond market.

- One tax advantage of annuities when compared to a standard taxable investment account is the deferral of any capital gains or income taxes in the annuity until the funds are withdrawn for spend down.

When a person invests in an annuity for income they can elect to receive payments immediately, or at a future date. The income from the annuities can be received monthly, quarterly, or annually. The payout will vary based on the underlying investment that is made, and the frequency of the payment as well as the age of he investor. Some types of annuities do not have fees, while others, which provide a guaranteed income stream have substantial maintenance costs. The basic types of annuities are listed below.

Fixed Annuity

This form of annuity will allow an investor to get the same payout or a fixed sum irrespective of what is occurring with interest rates in the market, which provides a more stable investment experience. Investors will receive this payment on a regular schedule and it will not change even if the market does; so from an income generation perspective they are similar to CDs.

Fixed Index Annuity

These annuities offer complete protection form downside risk while offering the investor returns linked to a market index. This feature makes a Fixed Indexed Annuity an ideal part of a retirement income strategy for many long term investors who are not comfortable with bonds due to rising interest rates, but still want to have a return on their money with no risk of market losses.

Variable Annuity

The value of a variable annuity can fluctuate with the investment held in this type of annuity. The payout amount, in general, does not decrease. If the annuity investments perform well, a person will get a higher payout by waiting to take their distributions at a later date.

While investors in variable annuities can enjoy a larger payout, many financial experts recommended investing in the fixed annuity instead. Retirees like the security and comfort of having a reliable income stream every month and being able to plan their finances around it.

Conclusion

At the end of the day, investors should see the advice of qualified Financial Planners, and Wealth Managers as well as take a concerted effort to put in place retirement income and/or investment portfolios that are customized to their individual preferences and needs. This means having a clear roadmap of the strategy from both a micro and macroeconomic perspective, understand each of the investment instruments bring implemented, how their asset allocation is deployed and optimized, actively monitoring and making adjustments when and where needed.

Given our interest rate environment, neglecting to do the above is irresponsible and will have undesirable outcomes for your retirement readiness and investment portfolio.

"Although interest rates are on the rise, we feel they will remain relatively low while the rate increase will be measured", says Sovereign Wealth Manager, Gary Korolev, “if early retirement investors and existing retirees don’t know what strategies to implement or mix of securities to invest in when choosing bonds, real estate investment, annuities, hedge and interest funds, their portfolio performance could suffer."

Sovereign Retirement Planning Service Areas

The content provided is for informational purposes only and should not be considered a recommendation of any particular strategy or investment product or investing advice of any kind. Information contained herein has been obtained from sources deemed reliable but Spire Wealth Management, LLC and its affiliates do not guarantee its accuracy. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the opinions of Spire Wealth Management LLC, Spire Securities LLC or its affiliates. Investing involves risk, including the possible loss of principal.