Annuities and High-Interest Rates: A Good Time to Consider Securing Your Investment

The interest rate and the Fed have been hot topics of concern for investors and consumers alike. The fluctuations in interest rates can significantly impact financial investments, particularly annuities. Annuities are a popular investment choice for individuals who are looking to secure their assets, including retirement income. Due to the recent rate increase, payouts for annuities have also increased, making it an excellent time for investors to consider investing in annuities until rates go down again. Inflation forecasts also suggest that annuities are an attractive proposition for investors looking for a secure and stable retirement income. When investors purchase annuities while rates are high, the strategy can provide an even more viable investment option for those seeking guaranteed income during their lifetime.

Over the past three months, investors have been kept on their toes with unexpected events in the market. Beginning with the run on Silicon Valley Bank in March, investors had to contend with the possibility of the collapse of American lenders. With the subsequent takeover of First Republic, it appeared that the threat of bank failures had lessened. However, concerns then shifted to the potential for America's politicians to cause turbulence in global markets by defaulting on their sovereign debt. At this point, the holiday was over, with investors no longer focusing on how high-interest rates should rise in response to inflation but on how much of a rate decrease was potentially needed to stabilize the financial system following the fall of SVB.

Attention is now refocused on interest rates, which have increased again. The yield on two-year Treasuries, which is exceptionally responsive to the Federal Reserve's policy rate, dropped to 3.75% in early May but has risen to 4.4% since officials discussed the possibility of raising rates beyond the current 5-5.25%. Traders in interest rate futures, who had been predicting rate reductions in the near future, are now anticipating the stabilization of rates at current levels with an eventual decrease in order to avoid an economic slowdown or another crisis.

Due to the recent increase in rates, payouts for annuities have dramatically risen, which makes it an ideal time for investors to consider this investment option until rates inevitably decline again. Inflation forecasts further suggest that annuities are an attractive proposition to consider, particularly for investors seeking secure and stable retirement income. Indeed, when interest rates are high, annuities can provide an appealing investment option for those seeking high guaranteed cashflow during their lifetime.

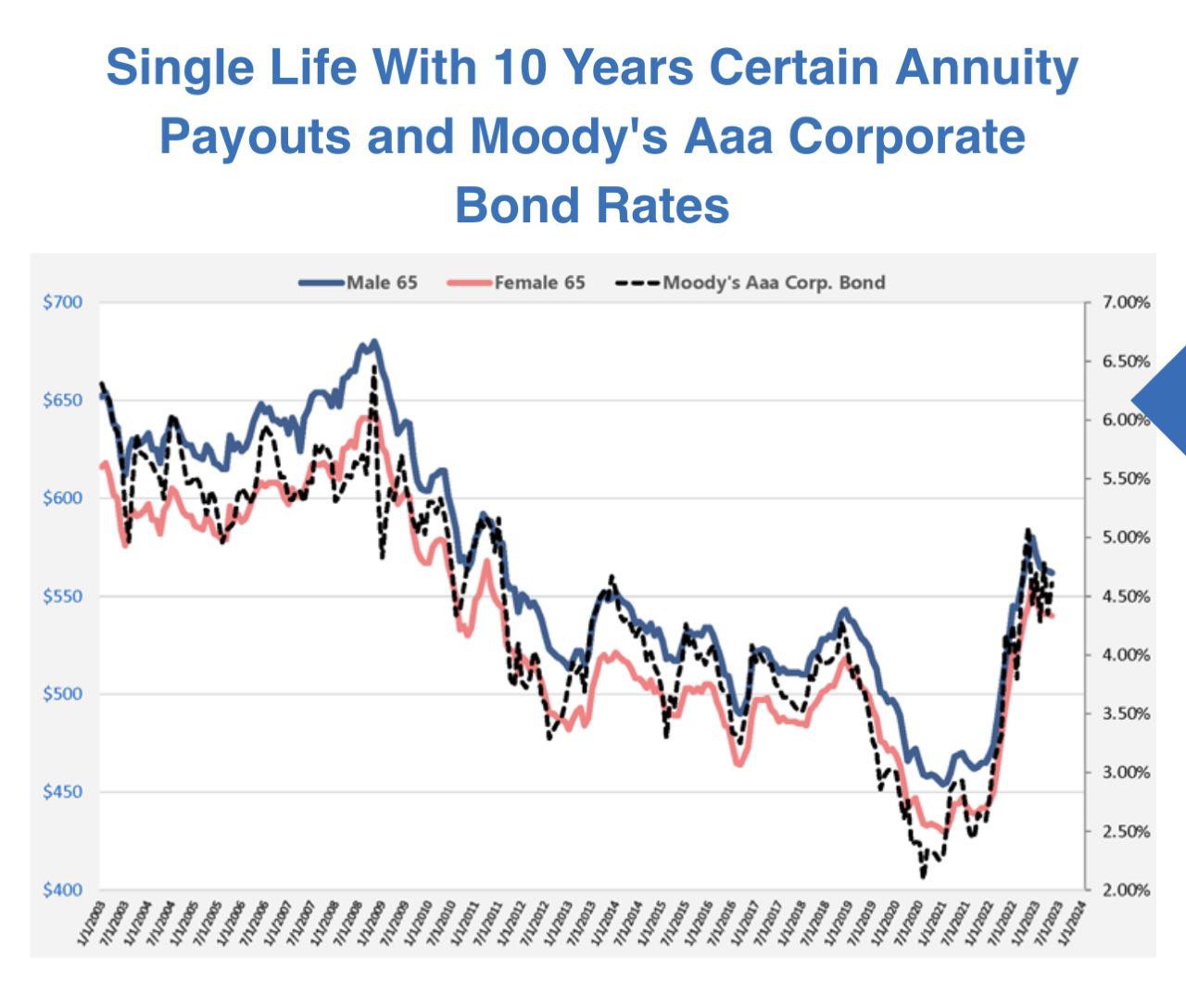

Source: IMMEDIATE ANNUITIES.com

Essentially, annuities serve as a contractual agreement between an investor and an insurance company, where the investor contributes money into the contract, and the insurance company agrees to pay the investor a regular stream of income during the specified period or their entire lifetime, much like a pension. Given these benefits, annuities are an excellent investment alternative for individuals who wish to secure a dependable income stream during retirement.

Annuities often pay out a much higher rate to an investor than he can afford to withdraw from his investment portfolio since the annuity companies use the laws of large numbers and statistics to their advantage. An individual or a couple need to plan for getting a stable benefits stream for an entire lifetime or living well into their 90s, while an annuity company only has to plan for the average lifetime, which is much shorter, or somewhere in the high 70’s to low 80’s in terms of life expectancy. This is the big reason why an annuity company can afford to pay out much higher rates, knowing it will not run out of money versus an individual investor.

Annuity companies generally employ the means they receive from investors to invest in bonds. When interest rates increase, bonds generate higher interest income for annuity companies, making it easier for them to pay higher rates to their investors. To sum up, in times when interest rates increase, annuities have the ability to offer higher payouts, making them an excellent investment option for investors until interest rates decrease again.

In summary, interest rates are still high but forecast to decrease, therefore if an investor wants to lock in the higher rates for life, they can do so by purchasing an annuity that pays a lifelong income stream at these higher rates before regulators and market forces bring them down again.