Stepping Back – What Happened Over the Weekend and Monday?

The Japanese yen is the world’s funding currency, meaning, institutional investors, (the type that move markets) borrow yen due to its low interest rates, (the famous carry trade) and “carry” it to other markets around the world to invest in assets and in turn help drive markets upward. Lately, the Japanese have been getting nervous about their depreciating currency. In addition, China needs to stimulate but can’t due to strong dollar and the need to keep the Chinese yuan pegged to the dollar at a certain rate.

Remember Yellen’s trip to China, and Japan? This was likely to coordinate the ability for China to stimulate while being able to manage their currency, at the same time accommodating the Japanese in their need to strengthen the yen. To do this, the dollar has to be weakened. The dollar has in-turn been weakened by Japan intervening in the currency market to increase the value of the yen, while supplementing with the first rate hikes into positive territory since 2007.

The result? Look at the change in the price of the yen in dollars below, a gain of over 12% since mid-July. (chart below) Now, what do you think happens when the world’s “funding” currency all of sudden becomes 12% more expensive? Institutional investors are on balance less enthusiastic to invest in the stock market, and it follows that stocks much more vulnerable to a correction on any negative news. The negative news that tipped the scales in favor of this crash? A weak US jobs number.

What’s Next?

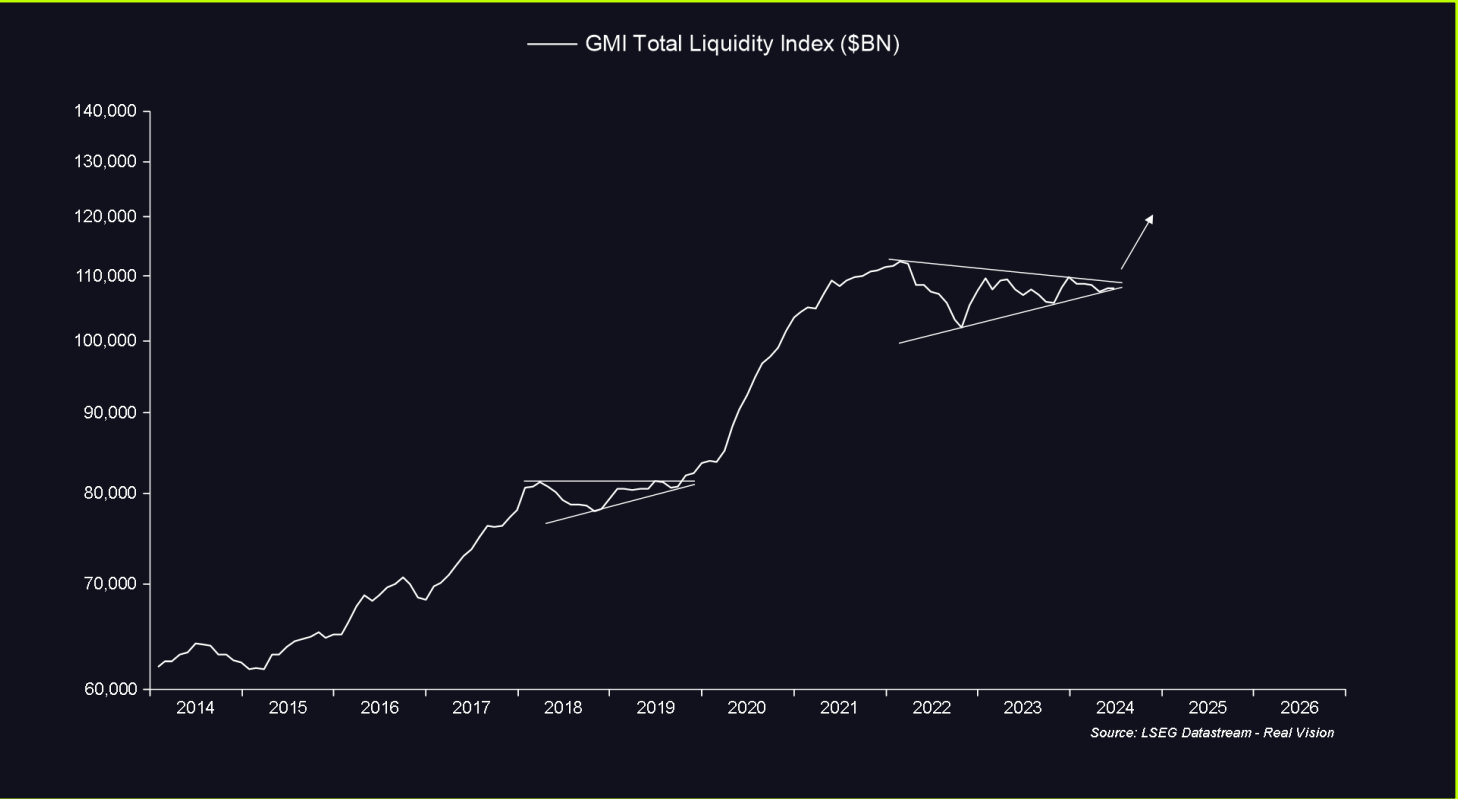

In a world overburdened with debt, the need to refinance that debt is what drives the liquidity, the business and the interest rate cycles, therefore in order to keep the train on the tracks, or the capital markets functioning, the world’s major central banks have to continue debasing the currency, or “adding liquidity” to the markets, however do the post-COVID bout of inflation, the FED could not just stimulate without an excuse due to the fear of being seen as capitulating and risking reigniting the inflation.

Now, the FED has an excuse to be more stimulative, by further lowering rates as well as adding liquidity to the system, thereby helping the markets continue their march upward. This current bout of volatility is likely to last several weeks at which point the market should positively respond to the FED’s increasing of liquidity. (chart below)

How Are We Positioned in Clients’ Portfolios

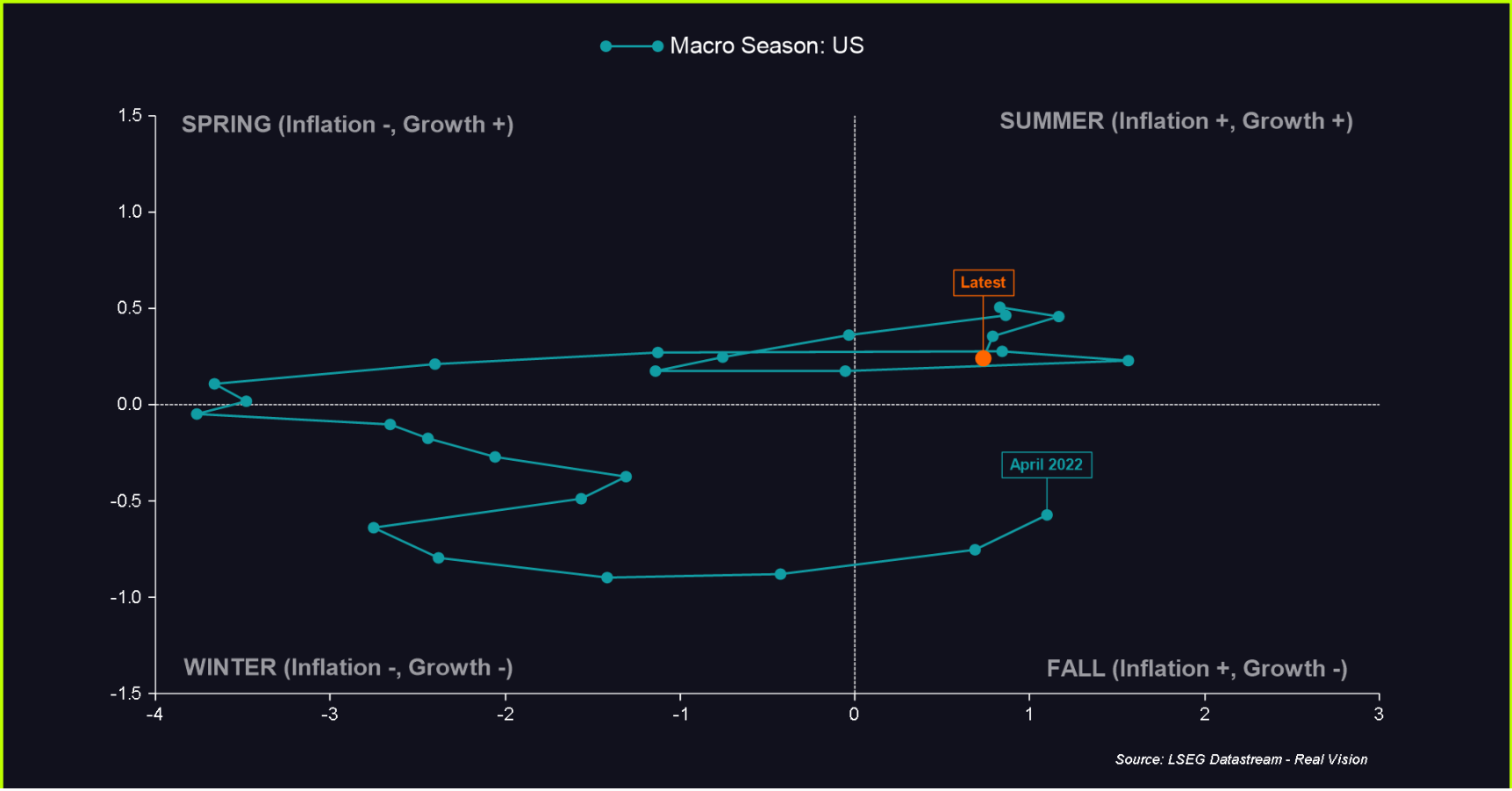

We continue to stay invested in risk assets. As our clients are aware, we focus on the medium to long term. Our thematic approach to investment selection is also greatly influenced by the current liquidity environment as well as business cycle analysis, supplemented with technical analysis. The data and research which we use to make our capital allocation decisions is showing that we are still in the part o the liquidity/business cycle which is called Macro Summer by the great research firm GMI, or a time when it is appropriate to be risk-on due to an overall favorable environment for risk assets such as stocks and crypto caused by an overall improving financial conditions, (albeit with some bumps along the way) and a supportive Fed.

All of this of course comes with a huge disclaimer stating that all analysis and outlooks are probability based and far from certain. For instance, a serious conflict between Iran and Israel which get the US involved would put an additional damper on any positive market developments. That being said, the key to successful long-term investing is constantly and diligently implementing a strategy which tilts probabilities in your favor given the best data available.